Since 2009 Gold prices have almost doubled, however, what most do not realize, it is yet to reach the heights of l980.

As Global investors seek a safe haven in gold amid the slowing & diving currency values and equity market drops, investment gold surpassed jewellery as the leading driver of global gold demand for the first time in 30 years.

Gold has been a valuable and highly wanted precious metal for a great many things – jewellery, coins, medicine, dentistry, industry, symbolisms, ideologies and many other forms since before recorded history, with gold prices being the most common basis for money policies throughout human history.

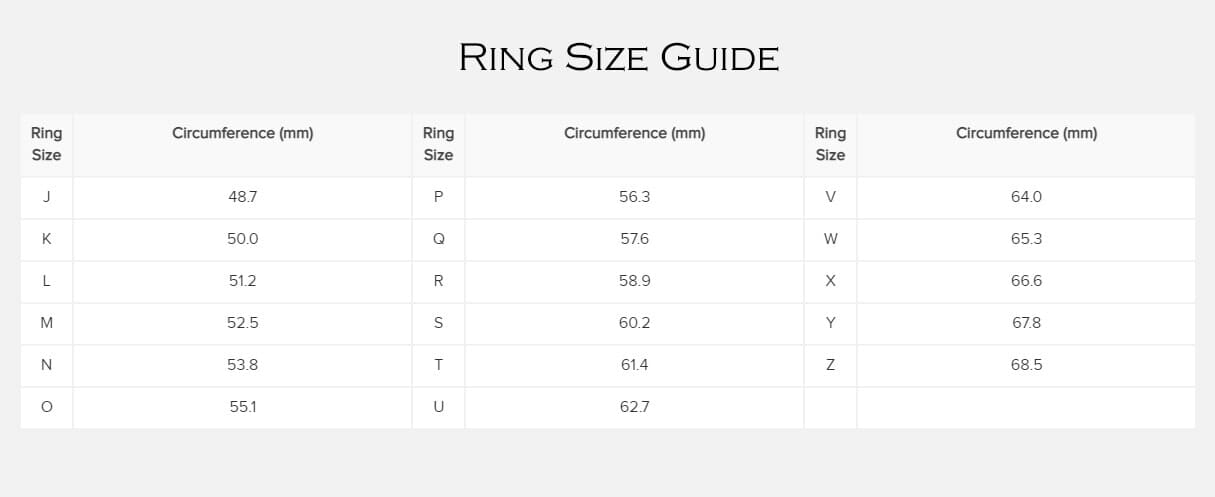

Generally measured by grams, when other metals are included (alloyed) the word carat is used to indicate the purity of the gold that is present. 24 carat being pure gold.

The price of gold is determined by the trading in the gold and its derivatives markets. The Gold Fixing, a procedure known as such, started in London in 1919 provided a daily benchmark price to the gold industry. Believe it or not, an Afternoon Fixing was introduced in 1968 when the United States of America opened its market. Gold was historically used as currency, and when paper money was introduced, it was a receipt that could be redeemed for gold coin or billion.

By l961, it was becoming hard to maintain a fixed price and a group of US and European banks agreed to manipulate the market to control currency devaluation against the increased demand for gold. In l968 the economic circumstances of the time caused the collapse of this group and a new scheme was begun. A two tiered pricing scheme was established – international accounts were settled at an agreed price, but on the private market gold was allowed to find its own level.

To this day, Central banks hold gold reserves as a store of value, however, this level has been dropping – the largest of these deposits in the world is that of the U.S. Federal Reserve Bank in New York, it holds approx. 3% of the gold minded (so too the U.S.Bullion Depository at Fort Knox).

In March, 2011, gold hit a new high for all time, of $1,432.57, based on investor concerns regarding the continual unrest in North Africa and the Middle East. In August of this year, Gold hit yet another high of $1,913.50

Private holders of gold store it generally in bullion form or bars as a hedge against inflation, cashed in when the Gold prices are high. Most believe they are not in a position to take advantage of this amazing opportunity, however, you may be very mistaken!

Scrap gold has become valuable due to this steady rising in the price of gold and we can all take advantage of it. There is a treasure trove of gold lying around most jewellery boxes in the home.

The true value of this may be realized by either cashing it in or trading it in against the purchase or creation of something you would like or perhaps would not have generally afforded. You can realise the true value of your old scrap un-wanted gold and jewellery at today’s prices. This can be the same for white gold and platinum – Rings, Earrings, Pendants, chains, anything that is made from any kind of gold or platinum.

Most genuine Manufacturing jewellers will willingly take on this old scrap gold as they can take advantage of a better price for part of their production costs and at the same time offering their clients to take home something they will have forever and wear with pride at an excellent price.

To Trade in your Old Gold, and to take advantage of the amazing high price of Gold, may I suggest the following as a good start:-

- The daily gold price may be checked via various internet sites, however, may I recommend https://www.perthmint.com.au

- Then, gather all your items that you believe to be gold or platinum, any, don’t be afraid, you will be quite surprised.

- Choose a Jeweller you trust! May I recommend those that are Registered Valuers only?

- Have them weigh and test your items.

- Have them put a scrap metal price on your items, remembering this will be a second hand and not new Gold Price.

- Suggest that you Trade your items in against a new piece

- Or, better still; utilize this towards having a new piece commissioned especially for you.

Gold fever is here, and it will not pass in a hurry – my advice, take advantage of it.

More coming soon…